Global Watch Sales in Decline: Evidence of a Luxury Slowdown

The luxury watch sector entered a down-cycle in 2024, breaking years of boom. Official figures paint a stark picture: Swiss watch exports fell by about 2.8% for the year, ending a streak of record growth. Sales drops were especially dramatic in Asia – Greater China saw declines of roughly 26–30% – but Western markets weren’t immune. Industry reports show Richemont’s watch brands (e.g. Vacheron, IWC) were down ~8%, and Swatch Group’s watch business fell ~12% in 2024. Even luxury conglomerates are warning of a new slump: a Bain/Altagamma study noted global personal luxury spending was flat or slightly negative in 2024, the first drop since 2008. They attribute this to inflation, economic uncertainty, and a “shrinking luxury customer base”.

Put simply, affluent consumers are pulling back. The Bloomberg Subdial Watch Index of pre-owned timepieces has fallen nearly 20% since mid-2023, reflecting broad weakness. For example, a second-hand Audemars Piguet Royal Oak Jumbo (one of the most coveted models) saw its price plunge by over 35% year-over-year. Such steep declines underscore that even established luxury watches are losing value, making the steep prices of new models harder to justify. In this environment of “luxury winter,” buyers who once eagerly paid premium prices are hesitating – and some are turning to replicas instead.

Consumption Downgrading: Trading Down to Affordable Alternatives

Economists call this pattern “consumption downgrading.” Faced with inflation and stagnant incomes, many middle-class shoppers in North America and Europe are cutting back on big-ticket items. A 2024 Bain report found that new watch sales “slowed due to consumer downtrading and selectivity”. Instead of buying a new Rolex or Omega, budget-conscious enthusiasts explore cheaper paths to style. This mirrors broader trends in luxury: younger consumers are less brand-loyal and value “small indulgences” over ultra-high-priced goods.

For watches specifically, this means seeking affordable luxury. Some downsizing buyers might buy entry-level luxury brands, or pre-owned pieces, but many are now looking at high-quality replicas – watches that closely mimic expensive brands at a fraction of the price. This is especially true as rising retail prices and limited discounts have eroded the value proposition of genuine luxury timepieces. In short, with authentic watches becoming almost too costly or speculative, replicas offer a compelling alternative.

Super Clone Watches: The New Niche of High-End Replicas

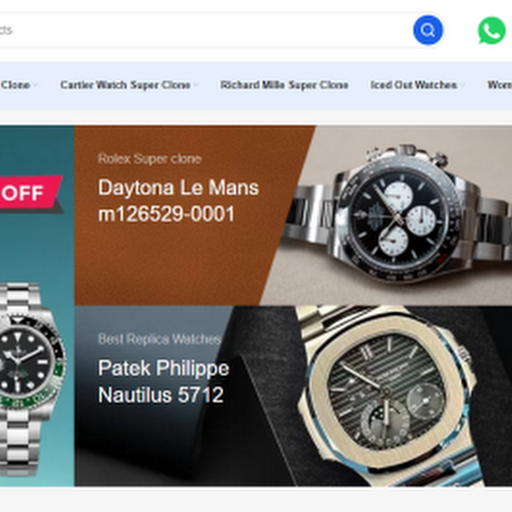

At the top end of the replica market are super clone watches – meticulously crafted imitations that aim to mirror every detail of the original. These are not flimsy fakes; they are often built with real sapphire crystals, solid steel cases, and even custom-developed movements. As one industry observer explains, “Super Clones” are engineered to match authentic watches “in every possible aspect… some even house custom-developed movements meant to replicate the original’s specifications”. In practice, that means high-precision cases, accurate logos, and mechanical motions that feel genuine.

For example, one retailer advertises its clone line as “Best Rolex Super Clone Watches… crafted with Swiss precision to mirror every detail of the original,” offering the “look and feel of genuine Rolex craftsmanship”. These sellers use the phrase “1:1 replica” or “Swiss replica” to signal top quality. In other words, the Super clone segment supplies would-be luxury buyers with timepieces that closely mimic the design, weight, and even internal workings of iconic brands – but at budget prices.

Key features of the super clone niche include:

Precision Craftsmanship: Makers use advanced machinery and skilled labor to duplicate dials, cases and movements. Many Super Clones have features (sapphire glass, ceramic bezels, polished finishes) nearly indistinguishable from the originals.

Wide Brand Selection: Nearly every luxury name has its clone counterpart. From Rolex Submariners to Patek Philippe Nautiluses and Richard Mille-style tourbillons, clones span the full spectrum of high-end models. Notably, Rolex models dominate the segment – one CEO of a watch retailer notes “half of [the replica] market is comprised of Rolex fakes” – but clones now target all major brands.

Affordability: These watches often sell for a few hundred dollars instead of tens of thousands. For instance, a clone Rolex Submariner might cost $700–$900, while the genuine article is over 100 times more expensive.

By positioning themselves as affordable luxe, Super Clone watches capitalize on the growing desire for status and style without the cost. Retailers even emphasize trust and authenticity of service to allay buyer concerns. In essence, a high-quality clone gives consumers “the same visual and tactile satisfaction” of a luxury watch for far less money.

Data and Trends: Clone Searches and Market Growth

The popularity of replica watches is borne out by multiple data signals. Google Trends shows a noticeable uptick in searches for “replica watches,” “homage watches,” and related terms – reflecting rising curiosity among consumers. In fact, an analysis noted that search interest for replica watches has “been steadily increasing” of late. Similarly, analytics firms report that traffic to replica-watch sites is climbing, indicating genuine market momentum.

Industry research corroborates this. A market report cited by Statista predicts the global replica watch market will expand in coming years, driven by rising demand for “affordable luxury”. This growth stands in stark contrast to the official luxury market, which Bain projects as essentially flat or slightly down through 2025. Moreover, insider commentary highlights the scale: business news outlets relay that retailers are seeing a flood of high-quality clones, from Rolex to Patek – indeed, even a generic watch executive noted “you see replica or clone watches – very, very high quality – of virtually all of the big luxury brands”.

To summarize the trends:

- Search & Traffic: Google search volume for “replica watches” and “cheap Rolex” has surged in 2023–2025.

- Market Projections: Analysts at Statista expect the replica segment to grow, as counterintuitive as it may sound.

- Industry Observations: Trade reports and executives confirm the phenomenon. For example, a 2023 interview noted that “fake Rolex watches make up half the luxury replica market,” underscoring intense demand for clones.

- Relative Performance: As authentic watch prices and resale values have dipped (e.g. a 20% drop in a leading pre-owned watch index), clones have remained stable, making them relatively more attractive.

These indicators together suggest that while official watch sales stagnate, alternative channels are thriving. In a business environment where brands warn of tightening demand, replica providers are reporting growing interest.

Why Consumers Are Turning to Clones

Multiple factors drive this shift toward replicas:

- Affordability and Accessibility: The most obvious is price. Genuine luxury watches often cost thousands (or tens of thousands) of dollars, putting them out of reach for most. In contrast, a super clone that looks nearly identical can cost a few hundred. As one observer notes, replicas “offer a way to enjoy the aesthetics of high-end timepieces without the financial burden”. For value-conscious shoppers in uncertain times, this is hugely attractive.

- Changing Value Perceptions: Many younger consumers and middle-class buyers emphasize style over authenticity. They admire the design and prestige of a brand like Rolex or Patek Philippe, but care less about provenance. To them, a well-made clone provides the desired image at a fraction of cost. This “enthusiast bootstrapping” lets them participate in the luxury narrative without the markup – effectively getting a similar look with minimal investment.

- Investment Considerations: Luxury watches were once seen as investment pieces, holding or growing in value. But recent market drops have shaken that notion. Faced with two years of falling secondary prices, even affluent collectors are more cautious. Some use clones as a “test drive” – wearing a replica to decide if a particular model’s style and heft truly appeal before risking real money.

- Social and Psychological Factors: Luxury timepieces often symbolize status. Not everyone wants to admit their watch is a replica, but social media influencers and peer groups sometimes blur the lines of authenticity. In lifestyle or fashion circles, an affordable “good copy” can satisfy the ego similarly to the real thing, especially as counterfeit identification becomes harder. In fact, experts warn that high-grade clones are now so convincing that even trained inspectors only spot ~20% of them on sight.

- Technological and Logistical Ease: The internet and global shipping make acquiring a clone seamless. A buyer in Europe or the US can order a “Super clone” Rolex or Patek through e-commerce, often with discreet packaging and direct delivery. This ease reduces the friction that once existed (think shady street markets). Meanwhile, online reviews and unboxings provide assurance, so more consumers feel comfortable making such purchases sight unseen.

In short, clones appeal because they satisfy the same desires as luxury watches (design, status, novelty) but with much less expense. The upscale quality of modern replicas (especially Super clones) means consumers feel they’re not sacrificing much in return for huge savings.

Industry Implications and Outlook

The rise of the replica market amid a luxury downturn presents a paradox. On one hand, it directly eats into potential sales of authentic brands – every clone purchase is one less sale or secondhand pick-up for Rolex, Omega, etc. On the other hand, it signals that brand influence remains very strong: the demand for clones is itself a testament to the desirability of these designs.

Luxury houses have responded by emphasizing exclusivity and anti-counterfeit measures (micro-etched logos, blockchain IDs, etc.), but such steps are slow to reach consumers and do little to alter the immediate economic drivers at play. With official channels tightening, the secondary and grey markets will also feel pressure: a Watchfinder report found up to 10% of watches received were knockoffs, highlighting how pervasive high-quality fakes have become even among dealers.

For 2025, most analysts expect the luxury segment to remain sluggish (Bain sees only slight improvement next year). Meanwhile, the replica niche is poised to keep growing unless legal or trade crackdowns intensify. Indeed, one silver lining for brands is that increased focus on replicas might drive some buyers back to official dealers who offer guaranteed authenticity. But unless the economy or consumer mindset dramatically shifts, the super clone market looks likely to persist as a budget-friendly countertrend.

Despite its controversial nature, the clone phenomenon is not going away. As one market report notes, the traditional watch industry may yet see “a slightly improving context” next year, but with “changing consumer preferences” that include appetite for affordable alternatives. In the end, the popularity of Super Clone Watches reflects a new balance: luxury brands must now contend with a mass of well-made imitators, while consumers exercise more choice than ever in how they wear their watch legacy.

Key Takeaways: Today’s luxury slowdown is driving many buyers toward high-quality replicas. Search interest in “replica watches” and “super clone” models is rising, supported by forecasts of growth in the replica market. With brand prices soaring and resale values falling (e.g. secondary Rolex/Audemars Piguet prices down by ~20–35%), clones offer a cost-effective solution. Sites like OusWatch specialize in Super clone watches – marketing them as “Swiss precision” 1:1 replicas of top brands – underscoring how mainstream this trend has become. In 2025’s “winter” of luxury, affordable rolex super clone and other replica options are a rare bright spot.

Artikel Terkait

Java FX: Platform Trading Forex Terpercaya dengan Edukasi Lengkap untuk Trader

Viral BMW Putih Pelat Dinas Kemhan 51692-00 Ngebut, TNI AU: Itu Palsu!

Gamis Bini Orang 2025: Tren Viral & Harga Terjangkau di Tanah Abang

AS Perintahkan Warga Negara Segera Tinggalkan Venezuela: Alasan dan Situasi Terkini